and authorities aware of this problem and to ensure that penalties are enforced. Janice already has 400 plus signatures to send to her local Member of Parliament.

and authorities aware of this problem and to ensure that penalties are enforced. Janice already has 400 plus signatures to send to her local Member of Parliament.

| SPINET - July Edition. |

|

|

Recent changes to the Childcare Rebate Act 1993 are specifically targeted to assist families in which a parent or a child has a disability.

Families who have a child with a disability up to the age of 17 may now be eligible to claim a rebate on their child care costs where the child has a diagnosed disability for which he or she requires significantly more care and attention than would otherwise be needed.

In addition, parents who are unable to work, study, train or look for work may now be exempted from the Childcare Cash Rebate work test.

The Childcare Cash Rebate, which is not means tested, is paid over the counter at Medicare Customer Service Centres and further information can be obtained from your local centre or by calling 132 124 for the cost of a local call.

LOOKING FOR CHILD CARERSThe Carers Association of Australia is conducting the first national survey of child carers - children under the age of 15 who care or help to care for parents or siblings who have disabilities. The Australian Bureau of Statistics has estimated that there are 33,800 child carers in Australia, with several thousand children aged less than 15 trying to care virtually full-time. Many other children help out in small ways, helping to entertain siblings or taking on extra household tasks while their parents are occupied in caring for the child with a disability.

As part of the project, the Carers Association is seeking to contact three groups of people:

If you come into any of these categories and you would be interested in participating in the project you can contact the Associationon (07) 3394 3822 or ring the Carers Association Child Carers Project on 1800 671 975.

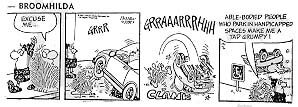

PROBLEMS WITH DISABLED PARKINGIf you're tired of disabled parking spaces being taken up by non-disabled with no consequences, then you're not alone.

A petition has been organised by one of our members, Janice Gibson, to make the public  and authorities aware of this problem and to ensure that penalties are enforced. Janice already has 400 plus signatures to send to her local Member of Parliament.

and authorities aware of this problem and to ensure that penalties are enforced. Janice already has 400 plus signatures to send to her local Member of Parliament.

If you would like to start up a petition in your area to send to your local Member of Parliament, please call Jodie at the Association for copies of the petition or Janice Gibson on 3372 8233 for more information.

|

|

TAX REBATE Medical or surgical appliances may qualify for a medical expenses rebate if they fit the Australian Taxation Office's definition. Ruling TR 93/94 concludes that "for an item to be a medical or surgical appliance, it must be an aid to the function or capacity of a person with a disability or illness. It is not sufficient that a medical practitioner prescribes an appliance for medical or surgical ends." An appliance is an aid to function or capacity if it helps a person perform activities of daily living. The Australian Taxation Office states that hearing aids, crutches, wheelchairs and car controls for people with disabilities would fit the definition of an appliance and qualify for the medical expenses rate. With privatization and close scrutiny of available funds, it is valuable to be able to share this information with our clients. |